If one was to run a political, economic, social, technology (PEST) analysis on the smart and advanced textile industry for the year, “P” would dominate, as politics has impacted all sectors. But that is not to diminish important developments that have taken place in the industry, in some cases because of the conflicts, and in others despite them.

PEST itself is being revised to reflect the importance of environmental issues, so that many are now looking instead at a social, technological, economic, ecological and political (STEEP) analysis. A January 2023 article in this publication looked at the year ahead; it’s time to see what did, in fact, transpire.

The industry in the past year has been marked by supply chain issues; more automation in manufacturing, including the use of robotics; improvements and greater usage of 3D printing; and the growth in interest and market size for biotechnology in textile development.

The supply chain

One might have expected “trust” to be the key driver of supply chains over the year, with clusters becoming increasingly important because of this. Tariffs were worth flagging as a continuing topic, as well. Valadis Dombrovskis, the European Union (EU) trade commissioner warned that the Inflation Reduction Act (IRA) risked making Europe more receptive to China, working against, rather than for, the stated aims of the U.S. legislation.

This past year, there was a concerted growth in cooperation for product research and development with a keen eye on forming a supply chain for full commercialization when the time came. At the Advanced Textiles Association (ATA) Expo 2023, the Advanced Functional Fabrics of America (AFFOA) announced their achievement in assembling a national network capable of supplying the next generation of fabrics, by establishing and leveraging a broad ecosystem of producers, researchers and government entities. This included launching a Product Accelerator for Functional Fabrics (PAFF) program designed to close the gaps and strengthen U.S. supply chains.

Tempering enthusiasm for re- shoring and near-shoring, Adam Posen, president of the Peterson Institute for International Economics (PIIE), cautions that “Buy American policies actually cost jobs.” He pointed to “rules of origin” as increasing product costs, thereby making U.S. business less competitive on the international marketplace. Post-COVID, some unintended consequences have begun to emerge as inconsistent demand for PPE has left smaller SMEs, in particular, exposed, leading to demands for reservation contracts, whereby the government could exercise an option with suppliers for increased production, should the need arise.

Transparency is being demanded from all stakeholders, from consumers to legislators. The EU introduced new rules on sustainability reporting. The Corporate Sustainability Reporting Directive promises modernization and a strengthening of the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, are now required to report on sustainability. The new rules are being applied in the 2024 financial year for reports to be published in 2025.

Robotics

At the beginning of the year, it appeared likely that there would be a drive towards greater automation and the use of robotics in driving efficiencies, safety and providing better quality, as well as more highly skilled jobs in the textiles industry. This was certainly borne out by presentations and panel discussions at ATA’s Expo 2023, where speakers, such as Graham Page, Alchemy X LLC, and Frank Henderson, Henderson Sewing Machine Co., espoused the value of robotics in manufacturing.

Page acknowledged the ongoing challenge of handling different textiles, as well as the bottleneck created in pick-and-place processes. But there is now a move away from an expectation that one process can work for every fabric, and instead, manufacturers are looking at vacuum grippers for heavier materials, and special needle heads for finer materials. Frank Henderson pointed to the usefulness of robotics in specialist stitching, such as 3D sewing on a curve, airbag manufacturing requiring synchronized sewing heads, and for high-volume manufacturing.

All of this points to the higher skill levels needed, making the industry more attractive to workers who can more readily see career progression opportunities. Artificial Intelligence (AI) and machine learning are also helping to create greater efficiencies, more timely quality control and more fully integrated manufacturing systems.

At the ITMA show in Milan, ACG Kinna, a Swedish automation innovator, demonstrated its robotic pillow-filling system that includes the capability to print smart labels and software to detect pre-programmed faults during production. Partnerships and acquisition of specialist companies are advancing their capabilities further, with the company becoming a majority shareholder of EyeTech AB, also based in Sweden, in November. EyeTech uses 2D, 3D and Deep Learning technologies for quality control inspection, measurement and robot guidance.

3D printing

In a 2023 article in this publication, I highlighted the potential for 3D printing to be used as part of in-space service, assembly and manufacturing (ISAM) capabilities being explored by the Dept. of the Air Force (DAF) and the United States Space Force (USSF). In their presentation at AT EXPO 2022, Orbital Composites discussed their plans to develop space factories capable of manufacturing in space autonomously.

By the summer of 2023, Orbital and industry partners, which included Axiom Space, received a Direct-to-Phase-II Small Business Innovation Research (SBIR) award worth $1.7 million from the U.S. Space Force (USSF). Their focus is on satellite-based cellular broadband (SBCB) and space-based solar power (SBSP) with manufacturing to include high-performance antennas built in space reducing costs more than 100 times, in addition to offering environmental benefits.

The timeline for the first space factory module is three-to-five years for the first commercial low-Earth Orbit (LEO) space station. Developments in scale and smartness have seen progress this year. In Germany, Mitsubishi Chemical Group announced the commencement of a 3D Printing Fused Granulate Fabrication (FGF) Engineering Challenge inviting interested parties developing products or parts with FGF and hybrid technologies to respond. The intention is to progress innovative approaches in 3D printing of FGF alone (as well as possibilities in hybrid technologies and materials such as carbon fiber) unidirectional (UD) tape and computer numerical control (CNC) machining.

Smart materials and 3D printing are being aligned by researchers at the King Abdullah University of Science and Technology (KAUST), Saudi Arabia, who are using shape-memory polymers (SMPs) in 4D printing. Digital light processing (DLP) is a vat-photopolymerization technique that uses a liquid crystal combined with customized resin to give the lattice structures shape-memory characteristics with potential applications including smart patches and meta-material sensors.

Biotechnology

At the beginning of 2023, my article on this site discussed the considerable consumer interest and estimated market size for biopolymers in 2022 ($10.7 billion) and growth projection ($86.7 billion) for 2023. The enthusiasm was tempered by issues around scalability, standardization of product, quality control and ensuring the reliability of supplies. So what progress has been made this year?

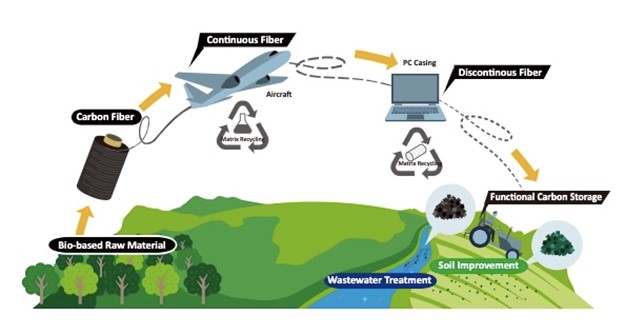

An interim solution has been found in the use of the material as a coating on natural fibers, so that, although it’s a hybrid, it retains environmental credentials. The German Institutes of Textile and Fiber Research (DITF) are using lignin as a bio-based coating to protect and extend the longevity of natural fibers in geosynthetic applications. Toray Carbon Fibers Europe has started the manufacture of a recycled carbon fiber (rCF) that is derived from recycled raw materials and biomass. It’s taken from the production process of the Boeing 787 components using their advanced carbon fiber TORAYCA. The rCF is based on a pyrolysis recycling process and, in a cooperation with Lenovo, it’s being used as a reinforcement filler for thermoplastic pellets for the Lenovo ThinkPad X1 Carbon Gen 12 ultra-light laptop.

Recovering carbon fiber from composites, diverting it from landfill to high-value products is a great example of what is possible. It’s also a case study in bringing multiple stakeholders together from very different markets. Scale, in addition to circularity, is really only going to be possible by thinking and working across disciplines.

Dr. Marie O’Mahony is an industry consultant, author and academic. She is a frequent contributor to Textile Technology Source.

TEXTILES.ORG

TEXTILES.ORG