How trade deals currently in discussion could impact the textile industry

As a presidential candidate, Donald Trump promised to improve U.S. trade deals, including the North American Free Trade Agreement (NAFTA). Since taking office and after threatening to withdraw the United States from NAFTA unless its terms were renegotiated, President Trump has cajoled Mexico and Canada to the bargaining table to revisit the deal.

The first round of tripartite talks commenced in Washington, D.C., on August 16, the day after the U.S. statutorily mandated comment and congressional consultation period expired. The quick start set a marker for the administration’s intention to move expeditiously in this effort. An additional round was held in Mexico City over Labor Day weekend. Regarding textiles, the talks have largely been focused on a technical discussion and information exchange versus getting into substantive decision-making.

NAFTA’S importance

Key political issues in the textile arena are expected to center around rules of origin and, more specifically, derogations from the industry-standard “yarn forward” rule. The textile sector has made its position clear on these matters to the administration:

- The agreement is vital to U.S. textile manufacturing prosperity, and

- It agrees with the administration that the deal can and should be improved.

NAFTA is crucial to the U.S. textile industry because Mexico and Canada are its two largest trade partners. Two-way trade between the U.S. and its NAFTA partners was $18.6 billion in 2016, up from $7.3 billion in 1993, the year before the agreement was implemented. Moreover, this trade generated a $3.5 billion trade surplus for the U.S. last year.

The NAFTA region enjoys vibrant fiber, yarn and fabric sectors in addition to end product assembly capabilities. As a result, an outright cancellation of NAFTA would be highly disruptive because of the level of supply chain integration in the region. As for improving NAFTA, the U.S. textile industry’s overarching request to the Trump administration is to build upon the successes of NAFTA through common-sense adjustments that would enhance U.S. production, exports and employment. It has identified three specific issues that it believes must be addressed.

Customs enforcement

The U.S. must have a stronger focus on customs enforcement and commit greater resources to it. During the past 30 years, there has been a systematic de-emphasis on commercial fraud enforcement at U.S. Customs and Border Protection (CBP). CBP suffers from both a lack of resources and focus, especially noting the uptick in the number of trade agreements and overall trade flows during this timeframe. Consequently, the benefits of these agreements have been siphoned off by third-party countries and importers willing and able to circumvent U.S. trade laws and agreements.

IFAI’s USIFI and NFI divisions are on record strongly supporting the adoption of a new mentality that places an increased emphasis on customs enforcement of NAFTA and other free trade agreements (FTAs). The administration and Congress should devote more resources to CBP to more effectively enforce U.S. trade laws and duty assessments. USIFI and NFI also note that more effective trade enforcement will not only pay for itself, but also generate new revenues that could be used to promote trade facilitation through the rebuilding and expansion of America’s infrastructure.

No exceptions

The U.S. should eliminate exceptions to yarn forward in the NAFTA rule of origin. Every U.S. free trade agreement includes what is known as “rules of origin” that define which steps must be undertaken for a product to be considered an originating product and qualify for the duty preferences afforded by the agreement. The standard rule of origin for textiles in nearly all U.S. FTAs is the yarn-forward rule, which requires yarn and every manufacturing step following the yarn stage to be done in the FTA region.

Yarn forward was originally devised under NAFTA and is the accepted rule of origin for the domestic textile industry because it reserves key benefits for manufacturers within the signatory countries. A yarn-forward concept is also markedly easier to enforce versus a value-added rule of origin. Although most U.S. FTAs are built on yarn forward as the basic structure, exceptions to the basic rule exist in many agreements that shift business away from U.S. producers to non-FTA parties, in particular, China.

These yarn-forward loopholes take many forms, with the most egregious being tariff preference levels (TPLs), an exception allowing for a specific quantity of goods to be shipped duty free among free trade partner countries even though some or all of the components therein are sourced from countries that are not signatories to the agreement.

Under NAFTA, Mexico is permitted ship annually up to the equivalent of 24 million square meters (SME) of certain fabrics and made-up textile articles, including man-made fiber industrial products, to the U.S., duty free. Canada has a 72 million SME TPL for this category of articles. There are three additional TPLs for cotton and man-made fiber yarns, cotton and man-made fiber apparel, and wool apparel. These and other loopholes and should be eliminated in any renegotiation.

Close the loophole

The loophole that dilutes the Kissell Amendment needs to be closed. The Kissell Amendment, 6 USC 453b, is a Berry Amendment-like “Buy American” law for textiles that applies to the Department of Homeland Security (DHS). In practice, however, DHS only applies Kissell to purchases by the Coast Guard and Transportation Security Administration (TSA) because of U.S. commitments made under the World Trade Organization (WTO) Revised Agreement on Government Procurement (GPA).

With respect to its application to TSA, Kissell has further been diluted. This is because the U.S. government failed to notify Mexico and Canada under NAFTA, as well as Chile under the Chilean FTA, that the United States was reserving TSA from the GPA when TSA was created. Thus, the United States has taken the position that those countries are acceptable as U.S. sources under Kissell. This oversight should be rectified in any NAFTA renegotiation.

Current status

It is not clear when the talks will progress to the decision-making stage; however, the three countries are planning an aggressive meeting schedule for the fall. The next round is tentatively scheduled for Ottawa in late September and the fourth round is to be in Washington D.C. in October.

The accelerated pace is aimed at wrapping up the renegotiation by early 2018 to avoid political complications given Mexico’s presidential election next summer, U.S. midterms, and the expiration of trade promotion authority. It is unclear at this early stage if this goal will prove attainable, but it is viewed as ambitious, given the usual pace of trade negotiations.

How to get engaged

Regardless of whether the talks can be finalized by the end of the year, the U.S. government is moving quickly in this effort. The Trump administration released their NAFTA negotiating objectives on July 17 and have already begun preparing and offering specific proposals for changes to the various chapters of the agreement’s text. Given the NAFTA trade volumes for textiles and significant supply chain integration, the NAFTA modernization effort could have a major impact on the industry. As a result, engagement with Washington decision makers is critical at this juncture.

The USIFI and NFI divisions are actively engaged in collecting and providing input to the administration, as well as keeping member companies abreast of any significant developments in the talks. They welcome additional members that share the goal of strengthening the terms for U.S. production.

Sara Beatty and Lloyd Wood are the Washington representatives for IFAI’s USIFI and NFI divisions. They each have 14 years’ experience advocating on behalf of domestic textile manufacturers.

Narrow Fabrics Institute

https://narrowfabrics.ifai.com

U.S. Industrial Fabrics Institute

https://usindustrialfabrics.ifai.com

Contact: Janelle Wells

(651) 225-6948 ; jawells@ifai.com

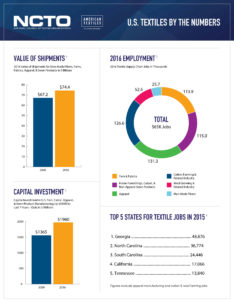

SOURCES for information in the graphics:

- U.S. Census Bureau, Annual Survey of Manufactures (ASM), value of shipments for NAICS 313, 314, 315, & 32522. 2015 data used to compute 2016 NAICS 32522 figure.

- Bureau of Labor Statistics, Dept. of Agriculture, Nat’l Cotton Council, and American Sheep Industry Association.

- U.S. Census Bureau, Annual Capital Expenditures Survey (ACES), NAICS 313, 314, & 315.

- Bureau of Labor Statistics, Quarterly Census on Employment and Wages (QCEW), NAICS 313, 314, & 32522 only.

- U.S. Department of Commerce and U.S. International Trade Commission

- U.S. U.S. Department of Commerce and U.S. International Trade Commission, data for U.S. exports of yarns and fabrics only.

- U.S. Department of Commerce and U.S. International Trade Commission, Data excludes U.S. exports of raw cotton and wool products.

TEXTILES.ORG

TEXTILES.ORG