Since the pandemic, the world economy has been run by anomalies. With a strong labor market, one normally expects higher demand in daily nonessentials such as clothing, home textiles and home accessories; the financial reports of major retailers, such as Walmart and Canadian retailer Loblaws, show that year-on-year sales have increased. But an analysis of the reports shows an interesting picture: the increase in revenue has been primarily due to food and grocery items, which have been severely impacted by inflation.

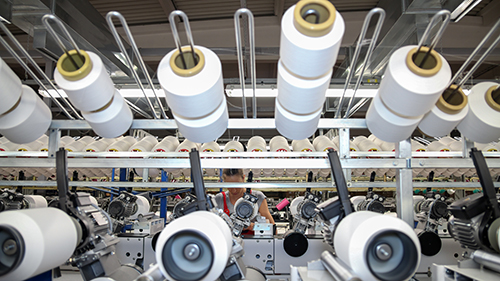

Inflation in developed economies and the onslaught of deflation in China is having an impact on the textile industry, particularly in export-oriented countries such as India and Bangladesh. The textile industry in developed nations is also not immune to harsh economic realities. As such, the global textile sector has been examining ways to shield itself in the future from such demand fluctuations, price volatilities, climate change scenarios, growing regulations, environmental influences, as well as labor shortages, skills issues and costs.

Strengthening domestic manufacturing

What are the incentives to grow domestic manufacturing? In a word, jobs. While it is no secret that building and developing new industries—while enhancing the efficiencies of existing ones—can boost the economy, it is important to take action strategically. It makes no economic sense, for example, to pump millions of dollars into a sector which may not have comparative and competitive advantages against low-wage countries. In the globalized “flat world,” nations have to invest carefully and spend their resources in different segments of the manufacturing sector that offer economic advantages and tackle necessary needs.

The U.S. has a competitive advantage in terms of research intensive and high-end export-oriented segments, such as defense, aerospace, health and infrastructure. There are many different textile products that find applications in these sectors. Additionally, even in commodity products, where brand identity and quality occupy high priority, opportunities are there for growth and expansion.

Inflation reduction and growth

It has been a year since the inflation reduction act has become law. It was aimed at manufacturing growth, promoting cleaner energy and combating climate change. While the focus is on clean energy related sectors, such as solar and electric vehicles, peripherally there are opportunities for advanced textiles. Lightweight automobiles use fiber and other soft composites, battery separators and filters, which are made using fibrous substrates. Given the stringent quality requirements and the need for coordinated supply, OEMs prefer domestic suppliers to afford them better control over cost and quality.

Another important aspect of this law is enabling the reduction of greenhouse gas emissions by about 1 billion tons by 2030. Fiber-based products can play important roles in having energy efficient buildings by providing thermal insulation and the ability to adapt to changes in temperature. Glass fiber mats, soft composites and natural fiber-based textile materials can find renewed and advanced applications in infrastructure projects.

Industries in these segments could take advantage of incentives from the federal government by highlighting these products’ contributions in energy savings, as well as sustainable and agile manufacturing. Consumers who invest in energy efficient solutions can obtain up to 30 percent of the cost of insulation, up to a maximum of $1,200 per year in total expenses in tax credits. Industry and trade associations can support this by helping businesses advise end customers regarding government incentives available to them, as part of their marketing strategies.

The U.S. government is not alone in offering initiatives. Other nations, such as India, are supporting programs to boost the use of green energy in textile manufacturing. Industries in India that have installed wind power to offset soaring power costs are saving enough to keep them operational. Aruppukkottai, India-based Jayalakshmi Textiles has invested in windmills for power generation, which has enabled it to offset energy bill hikes and maintain its operational efficiency without mill closures.

“With reduced demand, conventional textile industries like spinning and knitting have been hard hit due to lower demand, high energy and raw material prices, and more importantly price volatility in natural fibers. Staying energy efficient, practicing product diversification and reducing the margins have helped our industry to sustain,” stated Velmurugan Shanmugam, general manager. The company operates a 70,000 spindles cotton spinning mill in South India.

Government initiatives

In the U.S., the Dept. of Defense has a major initiative to advance national security and manufacturing. Among the high priority areas for research and investments in the “Manufacturing Technology” (ManTech) program, which are applicable to fiber-to-fashion segments, are biotechnology, advanced materials, renewable energy generation and utilization. It is good to report that advanced economies, which have a reputation for neglecting it, are now serious about boosting manufacturing.

The FY 2022 funding for the ManTech program totaled about $695.9 million with congressional add-ons. Congressional leaders have understood the need for such initiatives and nearly doubled the presidential request in FY 2022 funding. For FY 2023, the President’s request for ManTech is about $502 million, which is again a steep increase from the previous year’s proposed budget from President Biden.

In India, there have been several projects launched at the central government level, such as Production Link Incentives and the National Mission on Technical Textiles. Over the past two decades, India and China have realized the need for diversifying their textile sectors, which have been focusing on export markets for growth. Technical textiles and nonwovens are seen as promising sectors for growth in the textile industry.

In 2008, I had the privilege of introducing the Advanced Textiles Association (ATA, then IFAI) to a wider audience in India in a major advanced textiles event in Coimbatore, and a representative of the association visited India for the event. The participation by the senior staff of ATA stressed the importance of international collaboration and the advantages of growing the advanced textiles sector, which has had a long-term impact.

Since the mid-2000s, many educational workshops have been held as collaborative efforts between the U.S. and India, with patronage from the government of India. These initiatives have resulted in major investments involving multinational collaborations with domestic entities. High speed spunmelt and spunlace machinery investments have been made, which have helped India to supply multinational brands and export roll goods to the U.S. and Europe. Investments were supported by government programs aimed at boosting domestic manufacturing in both domestic and export markets.

A domestic manufacturing renaissance

The textile sector in the U.S. and Europe is advanced and focuses on industrial, hygiene and medical products, with the supply chain predominantly domestically located. In apparel, active wear and sportwear markets, major brands such as Nike, Under Armour and Adidas have become household names due to functionality, comfort and quality. In this segment, the entire supply chain may not be domestically situated. Trade or regulatory barriers in some countries make for the strong possibility that there will be other, preferred sourcing destinations; however, functional enhancement and finishing aspects are usually carried out within the boundaries of respective nations.

Areas that offer promise for domestic manufacturing—and which are not impacted by imports from cost-competitive countries—include: sustainable processing methods exploring alternatives to perfluoroalkyl and polyfluoroalkyl compounds (PFAS); custom clothing designed for special needs, such as for children on the autism spectrum, and elderly people with disabilities; next-generation fibrous substrates as chemical, biological and radiological countermeasures; and adsorptive products for fentanyl and other addictive compounds.

Strategies going forward

Investments in “green” products and energy offer tremendous scope. The industry has to focus on cost and quality conscious textile products for single-use and durable applications. There are plenty of opportunities for domestic investments in textile products that cater to health care, hygiene, defense, homeland security and the energy storage sectors.

In addition, the industry should have good outreach efforts through its advocacy groups such as ATA and Chambers of Commerce. Another means to boost domestic manufacturing is to explore new products and applications through active collaborations with academia and research laboratories, such as the National Renewable Energy Laboratory, the U.S. Dept. of Agriculture Regional Research Centers (in particular, the Southern Regional Research Center) and various U.S. military research facilities.

The advanced textile sectors of the industry should not only focus on domestic markets, but also explore less exploited markets, such as countries in the Middle East and South Pacific. All these initiatives need proactive and effective outreach and engagement with policymakers, academia and international trade bodies. But domestic investments in advanced textiles are also viable and offer good growth opportunities.

Dr. Seshadri Ramkumar is a professor at Texas Tech University, Lubbock, and a frequent contributor to Textile Technology Source.

TEXTILES.ORG

TEXTILES.ORG